How To Transfer My Epf Pension Amount

If you want to transfer your Pension Fund to any new ac then plz. You receive the pension amount from this Employees Pension Scheme.

The Complete Guide To Employee Pension Scheme Eps 1995

A useful online EPF pension calculator for you to calculate your future pension salary.

How to transfer my epf pension amount. PPO Enquiry Payment Enquiry Know Your Pension Status Disclaimer-The information provided on this website is intended for information purposes only and it is subject to change without notice. EPF Pension Calculator. Welcome to Pensioners Portal.

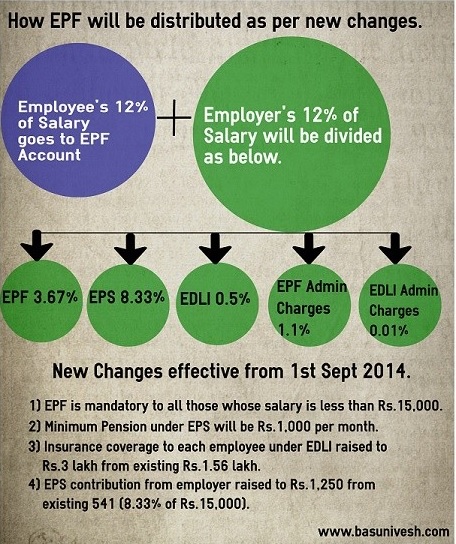

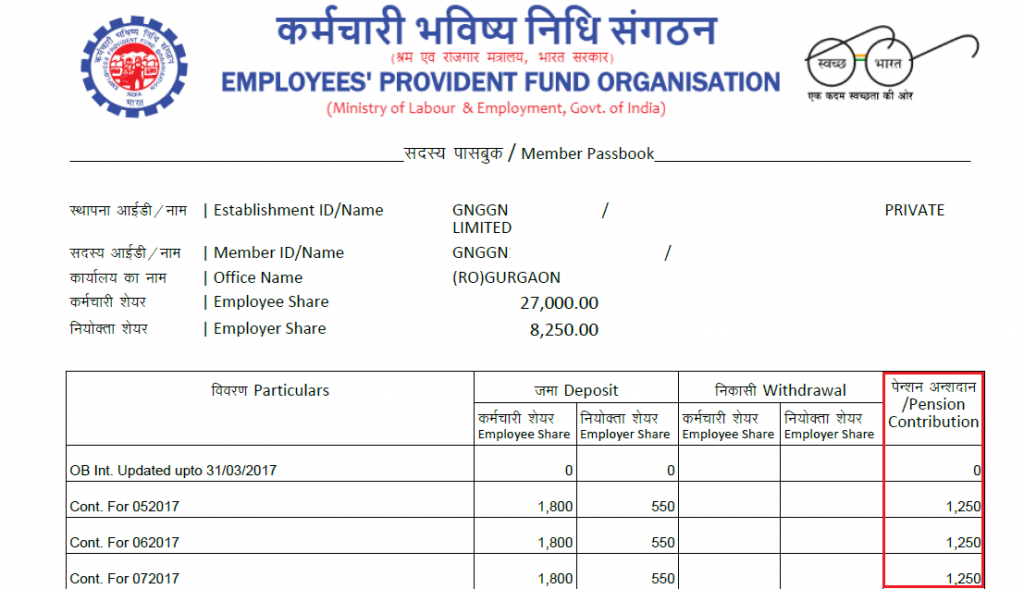

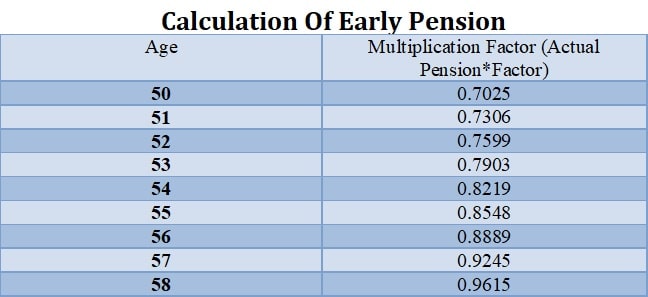

So you may now be depositing Rs 1800 towards EPF. The employee pension scheme calculation is based on the age date of joining of service the estimated or the salary recieved after completion of service 58 years and the pensionable part of your salary. Those who are interested about NPS and want to transfer their EPF corpus to NPS can get the chance.

The Employees Provident Fund Organisation EPFO has made provision for employees to transfer EPF from the previous employer to a new employer with ease. Note that only pension fund will not transferred the EPF Fund will also got transfer with it. Go to EPF grievance portal Select PF member Enter your UAN Enter your basic details Click on your present PF member ID Select category as Non transfer of PF Type your message Submit the request.

Hence an individual must withdraw the EPF amount or transfer it to the new employer at the earliest. Dear Divesh Plz. At the time of transferring EPF account two things gets triggered at PF office - a transfer of PF balance to the new EPF account and b transfer of service period record for the purpose of pension.

Note that the ac number of a member for EPF EPS is always same. Members of the Employees Provident Fund Organisation are eligible to receive pension if they satisfy certain conditionsOnce the member has met the required conditions the amount of pension they are eligible to receive will be calculated based on a formula provided in the rules of the Employees Pension Scheme Here is a look at when an employee is eligible to receive pension from EPF. However in November 2017 the Bangalore bench of the Income Tax Appellate Tribunal made the interest earned on an EPF account taxable after an employee quits their job.

This PF amount along with interest helps an employee get a lump sum amount during retirement. Knows your PPO No. The number of years an individual has worked can be tracked with the help of the transfer.

The calculation of pensionable salary is of two types. If you became a member of EPFO after 16 th November. To transfer the EPF account you will have to submit Form 13.

You can withdraw EPS amount only when you are withdrawing EPF amount and that too if you have not completed ten years of service. Here the pensionable salary is considered as average salary Basic PayDAof past sixty moths. In case an individual changes jobs heshe will be able to transfer the EPF amount to the new Member ID but the pension amount will not be transferred and will remain in the old Member ID.

If you have completed ten years of service then there is no way to withdraw your EPS amount. But if you want to withdraw your EPF Fund and want to transfer EPS Fund then it is not possible. The state establishment number and your account number.

The minimum contribution used to be 12 of Rs 6500 in most of the employees cases now this is 12 of Rs 15000 pm. Enter the UAN ID registered mobile number and all details of the current employer. 1995 then the pension amount is pensionable salary x service period70.

On opening the page first check whether the account is eligible for PF transfer. EPF gives you a lump sum return after your retirement whereas NPS gives you lump sum as well as monthly pension after retirement. According to me you cant transfer your EPS balance because as you said you already withdrawal your PF amount but yes there is a question that how old your PF account if its more than 9 years old then you can transfer your EPS but if its less than then you already withdrawal all amount.

You will receive a Pension Scheme certificate for the EPS amount. The process for PF Transfer is seamless and straightforward with UAN Universal Account Number. The maximum pensionable salary of a month cannot be exceeded Rs 6500.

The transfer from Employee Provident fund to NPS is completely tax-free. To get this check for the former employer state using the. As mentioned above your employer contributes certain portion of your monthly salary towards EPS Pension.

What Is Employees Pension Scheme Eps Eligibility Calculation Formula

What Happens To Eps When You Transfer Your Old Epf To New Employer

Pension Calculation Under Employees Pension Scheme Wealthtech Speaks

Eps Employee Pension Scheme Eligibility Calculation Withdrawal

Understanding Employee Pension Scheme Or Eps

How Can We Withdraw The Pension Contribution From A Pf Account Quora

Pf Transferred But Pension Fund Not Transferred Why

What Happens To Eps On Transfer Of Epf Account Job Change

How To Withdraw Epf And Eps Online Basunivesh

How To Withdraw Pension Contribution In Epf After Leaving The Job Abc Of Money

Pf Transfer Online Procedure For Epf Transfer Through Epfo Portal

Posting Komentar untuk "How To Transfer My Epf Pension Amount"