Is Rent Tax Deductible In Ontario

Under the Canadian tax code interest paid on monies borrowed to earn an income is tax deductible. Use 20 per cent of the total rent paid including any tax or fee as part of that rent.

Pin On Emk Tax And Accounting Llc

If you are self-employed and use your home for business purposes or meeting clients you can also claim a portion of your rent as a Business Use of Home expense.

Is rent tax deductible in ontario. Line 21900 Moving expenses. Property tax is the actual tax on the home and lot. For example you can deduct property taxes for the land and building where your rental property is.

As with utilities the amount you deduct has to do with whether the rental property is also your personal residence or if you rent out the entire property. Even though youre able to take a rent tax deduction you cannot claim the rent you pay each month on your tax return. Property insurance mortgage interest only the interest advertising legal fees accounting fees property manager wages repairs property taxes utilities supplies and vehicle expenses if you fulfill certain.

The only scenario where its OK to claim a portion of your monthly rent is if you use your property for a trade or business. You can deduct property taxes you incurred for your rental property for the period it was available for rent. I was just curious if in 2017 I know rates may vary if I would get money back from trillium benefit claiming rent receipts.

Rent wont reduce your taxes owing for the year. Rent isnt deductible per se but you can apply for the Trillium Benefit where they send you a rebate cheque either monthly or in a lump sum. It is calculated by multiplying the assessed value by the local mill rate and is not necessarily the amount considered tax in the rental agreement.

Line 21400 Child care expenses. Typical expenses for a rental property in Canada are. Income greater than 500000 would not qualify for the SBD but would qualify for the General Rate Reduction GRR.

You may be able to deduct amounts that you have paid for child care. There are a few strings attached to it such as landlord cant be living in the unit. You may be able to deduct moving expenses if you move to continue your studies or for employment.

Land transfer taxes when you first purchase the property. Non-capital expenditures are deducted from your rental income in full in the year they occurred and reduce your overall tax burden. Id request a statement from your landlord for total rent paid and divide it.

When Do I Submit Tax on Rental Income. Rental Expenses That Are Not Tax Deductible The principal youre paying on the mortgage. Im slightly confused by the rules which state as a single non senior I can.

Question about claiming rent in Ontario on taxes. If you live in Ontario you can claim a tax credit for rent paid on your principal residence. Is Income Tax for Rental Property in Canada.

Just like utilities your deduction for rent is calculated by the size of your home office in relation to your residence. In Ontario the SBD is 17 and is applicable on the first 500000 of rental income. Depending on your personal situation you might be able to deduct some or all of your rent on your tax return.

Yes income from your rental propertys is taxable but not all of it. Penalties incurred on your notice of. My gross income is 31200 27171 after tax 2016 and I pay 1077month rent 12924year.

Tricky Deductions and Expenses You Cant Claim New Residential Property Rebate the holy grail of tax deductions. Any property taxes paid to your municipality can also be deducted. Seniors living in public nursing homes can claim the tax credit as well.

Make sure to claim the appropriate percentage of property tax paid to make sure youre filing your taxes correctly. This will depend on whether you are paying rent for personal living space or for business use. To qualify for the Small Business Deduction of 17 the rental income has to be Active Business Income defined below.

If the property was used to produce income these costs may be deductible against the. Line 31260 Canada employment amount. 1 As time progresses your total debt remains the.

These costs are considered personal in nature and therefore are not deductible. Your land lease payments do not qualify for any tax deductions as this is your principal residence. Use the property tax municipal licence fee andor school board fee for the home and lot.

One way to reduce your income tax liability each year is to take all of the deductions available to you. If you did not convert your basement into a rental unit until six months in the year you can only deduct property taxes for the remaining six months. As you will see later you can reduce your taxable rental income by deducting specific expenses like those you incur to get the rental property ready to rent or whilst renting out the property.

The tax credit is based on your adjusted family net income and is reduced when your income. If you bought a new property or made significant alterations to one for the sole purposes of renting it out you can get a GSTHST rebate.

Can I Claim Rent On Taxes In Ontario Tax Walls

Claiming Expenses On Rental Properties 2021 Turbotax Canada Tips

Home Business Ideas For Ladies With Home Business Insurance Ontario This Home Bu Home Business Ideas For Ladies Inspirational Quotes Wisdom Quotes Fitness

6 Tax Credits And Deductions That Can Save Students And Their Parents A Bundle Globalnews Ca

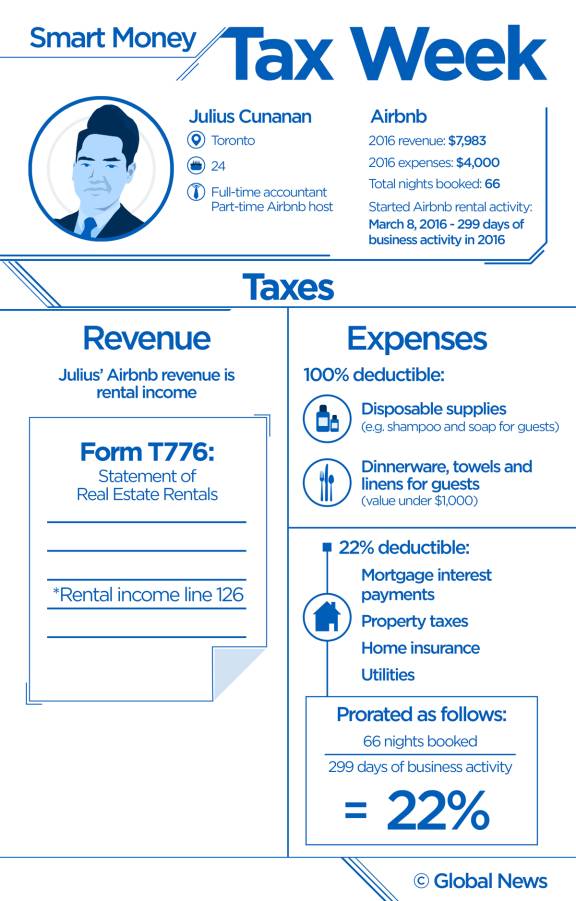

Airbnb 3 Things You Need To Know At Tax Time If You Rent Out Your Home Globalnews Ca

Canada Tax Deductions Tax Credits To Take Advantage Of In 2021 Tax Deductions Tax Credits Tax

Car Donation How Much Can I Deduct Car Enterprise Rent A Car Canning

Income Tax Return Filing Income Tax Return Tax Return Income Tax

Posting Komentar untuk "Is Rent Tax Deductible In Ontario"