Is Rental Income Taxable In New Hampshire

A landlord can also include a clause to force a mid-lease rent increase if property taxes are increased. Every penny will be paid by individuals with at least 2 million in assets or couples with 4 million.

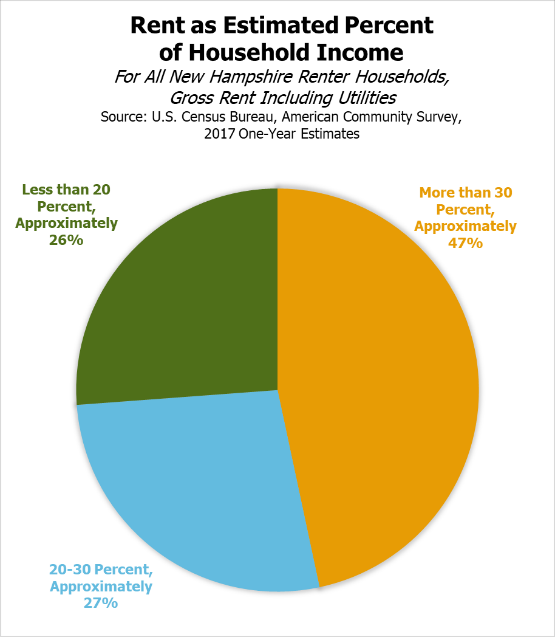

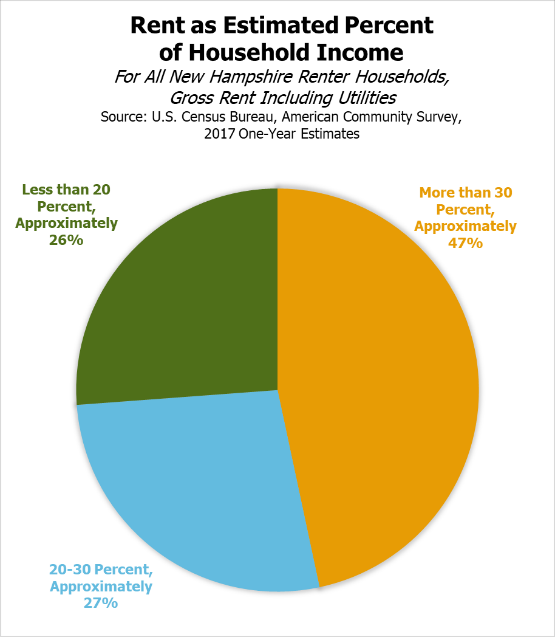

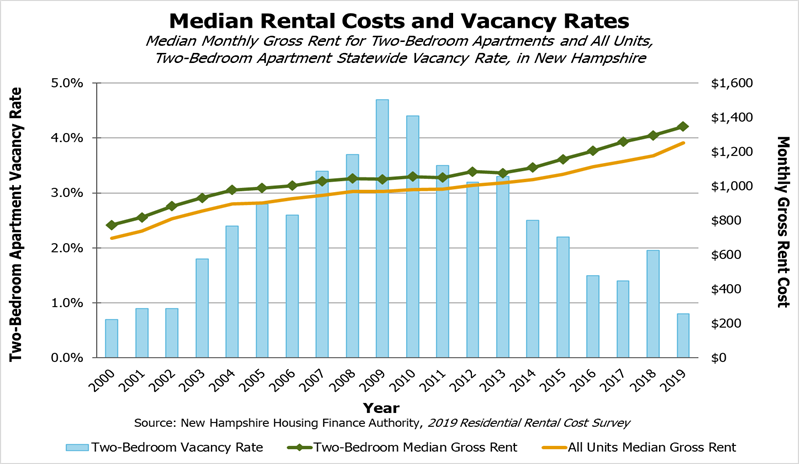

Continued Rise Of Nh S Rental Costs Increases Financial Burdens On Residents New Hampshire Fiscal Policy Institute

New Hampshire also does not have a gift tax but the federal gift tax will kick in if you give an individual more than 15000 in one calendar year.

Is rental income taxable in new hampshire. Do I need to pay the State BPT. It is currently the largest source of federal capital subsidy to create and preserve affordable rental housing. Income listed on a W-2 is not taxed at the state level which means that the vast majority of income earned in New Hampshire is not subject to any state taxes.

This states transfer tax is 075 of the sale paid by both buying and selling parties for a total aggregate of 15. New Hampshires law on security deposits RSA 540-A defines a security deposit as any money that a tenant gives to his or her landlord other than the monthly rental payment. 1 An amount not to exceed net income from rental properties from federal Form 1040 schedule E federal Form 8825 and federal Form 4835.

New Hampshire does tax income from interest and dividends however. Individuals in New Hampshire and Tennessee are only taxed on interest and dividend income. Also the state does not have a salary or wage tax but there is a 5 tax on dividends and interest earned on investments plus high property taxes.

Trusts subject to the tax may exclude income attributable to non-New Hampshire beneficiaries. No broad-based income tax. Single member limited liability companies are taxable entities for New Hampshire purposes.

Additionally a trust with freely transferable beneficial interests is not subject to the tax though distributions from such a trust to New Hampshire beneficiaries are considered income for ID tax. TurboTax messaging in the state tax return says bolded for emphasis. The Granite States low tax burden is a result of.

Based on what we know from your federal return you probably dont need to file a New Hampshire return. For multi-state businesses income is apportioned using a weighted sales factor of. No state sales tax.

In New Hampshire state Meals and Rooms Rentals Tax applies to your short-term rental. The buyer cant deduct this transfer tax from their federal income tax but they can roll the amount into their new. I own three rental properties in NH.

Low Income Housing Tax Credits LIHTC - New Hampshire Housing Low Income Housing Tax Credits LIHTC The Low Income Housing Tax Credit LIHTC Program provides a strong incentive for private investment in affordable rental housing. New Hampshires real estate transfer tax is very straightforward. And 2 An amount not to exceed 15 percent of the gross selling price as commissions on the sale of capital business assets.

This requires a nonresident tax return when the property is located somewhere other than your home state as does rental income earned there. The tax protects surviving spouses because an estate transferred to a spouse is tax-free. A BPT return must be filed if a business organizations gross business income exceeds 50000.

Yes rental activities and sales qualify for the Business Profit. New Hampshire requires a tax return only if you had t. However the Business Profit return is only required if your net profit from your rental exceeds 50000 and Business Enterprise Tax return is only required if your total sale income is more than 208000.

The estate tax will not affect 99 of the estates in New Hampshire. Federal taxable income of the business organization is the. No inheritance or estate taxes.

No capital gains tax. New Hampshire Income Taxes There is no tax on personal income from wages and salaries in New Hampshire. For taxable periods ending before December 31 2016 an 85 tax is assessed on income from conducting business activity within the State of New Hampshire.

For multi-state businesses income is apportioned using a weighted sales factor of two and the payroll and property factors. Gross business income is from all sources and not limited to New Hampshire sourced income. For taxable periods ending before December 31 2016 an 85 tax is assessed on income from conducting business activity within the State of New Hampshire.

Youd have to file a non-resident return if you worked as a consultant or contractor in another state. Carrying on a business trade profession or occupation in a state. Income from the sale of property.

Property taxes that vary by town. There are no additional local city or county taxes in New Hampshire. New Hampshire does collect.

A 5 tax on dividends and interest with a 24004800 exemption plus additional exemptions. A 9 rooms and meals tax also on rental cars. Apart from taxing business income through a corporate income tax or a personal income tax many states impose a separate tax on at least some businesses sometimes called a franchise tax or privilege tax.

These changes to our estate tax will make our tax system more just.

Affordability Gap Widens In Rental Housing Mind The Gap New Hampshire New Jersey

Real Estate Investment Spreadsheet Spreadsheets Passed Us The Possible To Input Revise And

Taxes States With No State Income Tax States That Do Not Tax Military Retired Pay As Of 9 June 2016 Financial Management South Dakota Income Tax

The Covid 19 Crisis In New Hampshire Initial Economic Impacts And Policy Responses New Hampshire Fiscal Policy Institute

What Kind Of Taxes Will You Owe On New Hampshire Business Income Appletree Business

Continued Rise Of Nh S Rental Costs Increases Financial Burdens On Residents New Hampshire Fiscal Policy Institute

Artwork 2017 States That Tax The Most Least V3 Calendar Creator New Hampshire Alabama Vs

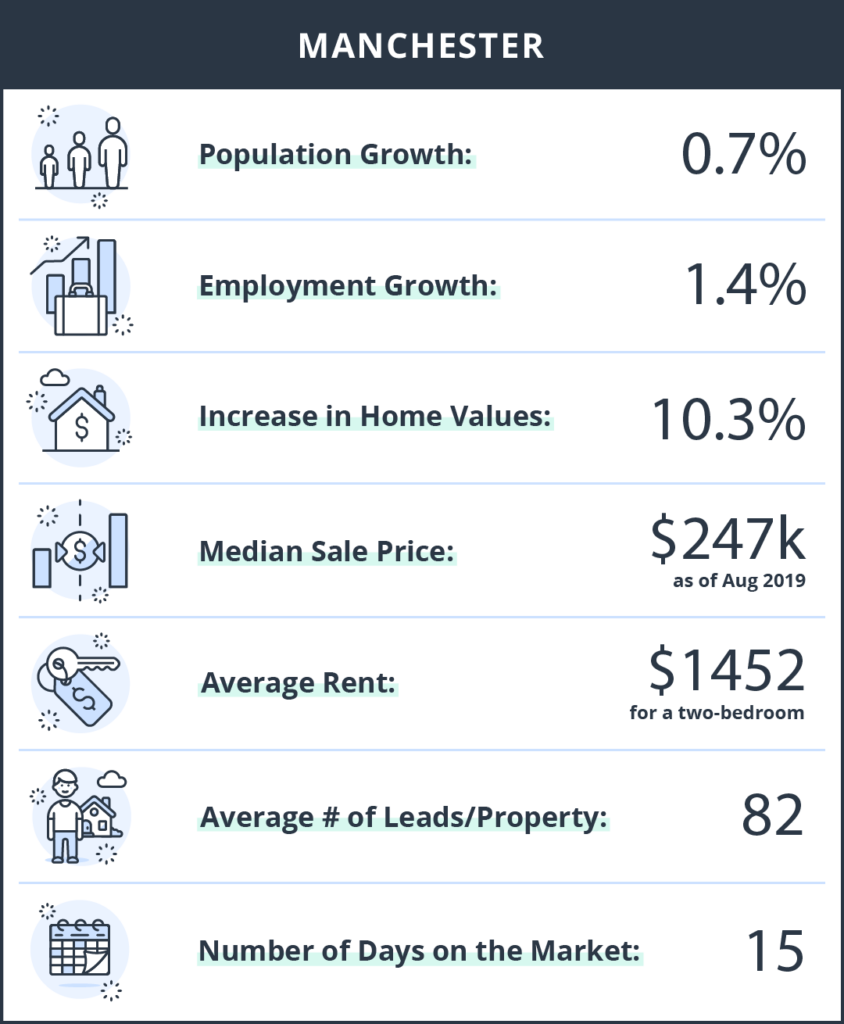

The Best Place To Buy A Rental Investment Property In New Hampshire

The Best Place To Buy A Rental Investment Property In New Hampshire

Posting Komentar untuk "Is Rental Income Taxable In New Hampshire"