Is Holiday Pay Included In Minimum Wage

This works out to 28 days for someone who works five days a week. This is because the law on overtime commission and bonus payments being included in holiday pay is based on the EU Working Time Directive which is 4 weeks holiday only.

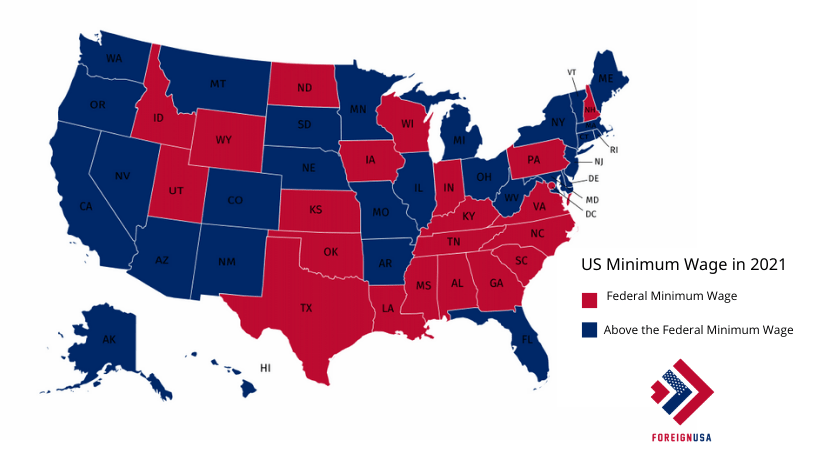

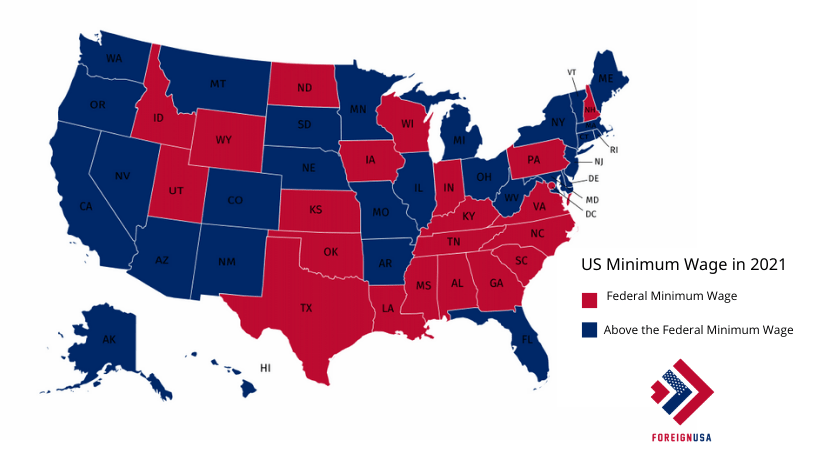

Minimum Wage In Us States All 50 Of Them In 2021 And All Previous Years

Additionally there is nothing in the law that mandates an employer pay an employee a special premium for work performed on a holiday Saturday or Sunday other than the overtime premium required for work performed in excess of eight hours in a workday or 40 hours in a workweek.

Is holiday pay included in minimum wage. Minimum wage earners MWE are exempted from withholding taxes for their holiday pay. Holiday pay should initially be included in the workers total remuneration. Holidays and Holiday Pay Workers are entitled to a minimum of 56 weeks paid annual leave including public and bank holidays.

Vacation pay holiday pay bonuses sick leave and severance pay are examples of wage agreements which may be made between employers and employees as a part of the employees total compensation. Holiday pay rules exist to protect the rights of workers to compensation thats due them. This goes the same with overtime pay night differential pay and hazard pay earned by an MWE.

For people whose working hours vary there is then a separate question which is how to work out a weeks pay. If a current contract. If your holiday pay has been included in your hourly pay Your employer might say that you dont get holiday pay because your holiday pay is included in your hourly rate.

If the worker takes the holiday then it is appropriate to consider whether the payment is in respect of an absence. This is called rolled-up holiday pay. You must make sure you pay your workers who are entitled at least minimum wage pay.

The entitlement cannot be replaced by payment in lieu and employers can contract to more than the statutory minimum but no less. If you think your holiday pay. If your employer is spreading your holiday pay over the year by adding an amount on top of your hourly rate this is known as rolled-up holiday pay and your employer should not do this.

Labor Standards investigates wage complaints involving minimum wage payment of wages overtime Sundayholiday premium pay and vacation pay upon termination as well as child labor parental and family medical leave and industrial homework. Under the Working Time Regulations 1998 almost all workers are legally entitled to a minimum of 56 weeks paid holiday per annum where annual leave will begin to accrue as soon as they start work without any qualifying period. What can I do if my employer is not paying the minimum wage.

Read the Guide to Wage and Workplace Laws in Rhode Island. Employers must pay the minimum wage to all employees including adults trainees starting-out workers and people with disabilities some exemptions may apply. If you have a workplace issue you may want to use the Early Resolution Service to resolve it early quickly and informally.

December 2019 This fact sheet provides general information regarding the regular rate of pay under the FLSA. You might be paid this way if youre an agency worker or on a zero-hours contract. Worked public holidays are paid at the rate of at least time and a half for the hours worked.

If you provide living accommodation a set amount may count towards minimum wage pay. You must get paid for your holiday when you take it. To see whether a workers pay is in line with the minimum wage you must calculate it in a particular way.

Your employer must pay you for all hours worked and many employers voluntarily pay employees time-and-a-half their usual wage for hours worked on holidays but it is not required by law. Is Holiday Pay taxable. Employment agreements can also include penal rates for particular days worked for example double-time for working on a Sunday.

An employer cannot include an amount for holiday pay in the hourly rate known as rolled-up holiday pay. There is no legal requirement to offer these benefits. Holiday pay should be paid for the time when annual leave is taken.

Where a union is recognised better rates may be negotiated through collective bargaining. Whatever your contract says your employer must always pay at least the National Minimum Wage for your holiday. Some employment agreements have a salary rate for unspecified hours or patterns of work or set wage rates for public holidays.

The FLSA requires that most employees in the United States be paid at least the federal minimum wage for all hours worked and overtime pay at not less than time and one-half the regular rate of pay for all hours worked over 40 hours in a workweek.

Minimum Wage In Illinois Cook County And Chicago Increases Take Effect July 1 Abc7 Chicago

Explaining National Living Wage National Minimum Wage Rates Increases For 2021 The Legal Partners

Understanding 2020 Us Federal Minimum Wage Laws Workest

Minimum Wage In Alabama Alabama Minimum Wage 2021

The 15 Minimum Wage What Does It Mean For Florida Sarasota Your Observer

The 15 Minimum Wage What Does It Mean For Florida Sarasota Your Observer

These 21 States Are Raising Their Minimum Wage For 2020

Map Monday States That Will See A Minimum Wage Increase In 2021 Allongeorgia

Minimum Wage In Alabama Alabama Minimum Wage 2021

Posting Komentar untuk "Is Holiday Pay Included In Minimum Wage"